Fibomachi is an automated algorithmic trading system. At his core, it has a proprietary black box predictive engine that takes price as the only data input. The algorithm itself is a multiple non-linear regression module based on Fibonacci numbers, the golden ratio and proprietary technical analysis modules.

Fibomachi uses the 1 minute chart and a low-frequency trading (LFT) strategy with an average of 2 to 4 trades per day, with a limit and a stop loss position on every trade.

The methodology used to create Fibomachi was based on producing a statistically quantifiable trading system without a heavy reliance on results derived from historical data analysis and backtesting. Instead, the system is designed with several range optimization dials (RODS) that safeguard against confirmation bias during backtesting. No data was excluded during backtesting and no data backfitting was performed.

NOTE: Fibomachi is an automated, proprietary trading system developed by Rudy Ibarra, which is available for sale or licensing from an interested and worthy currency trading/investment provider. For further information please contact Rudy Ibarra at rudyibar@gmail.com

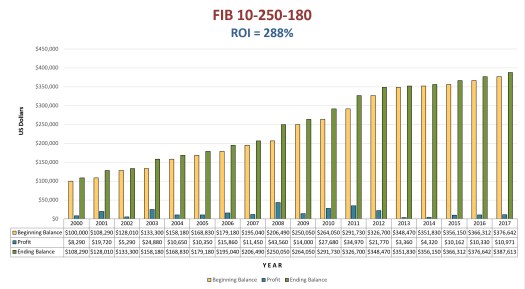

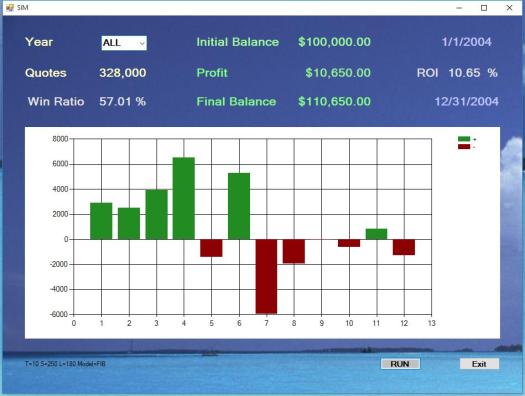

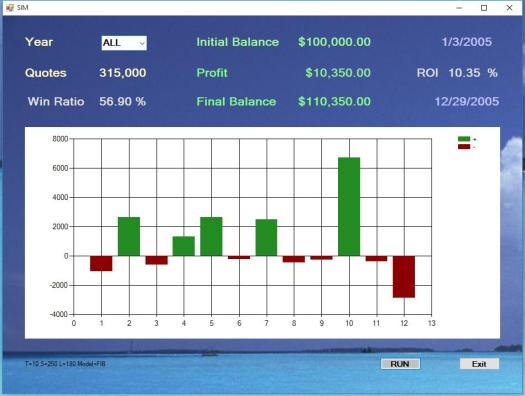

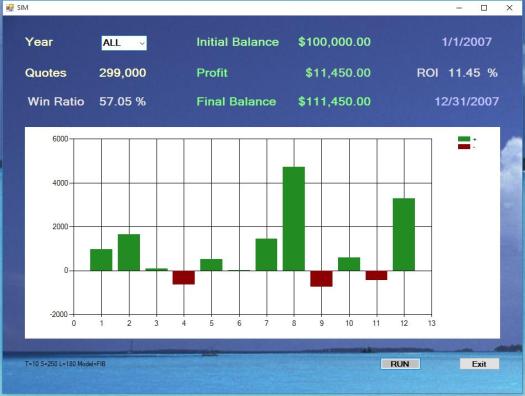

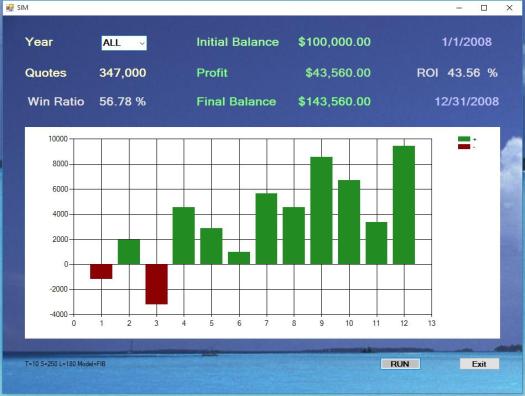

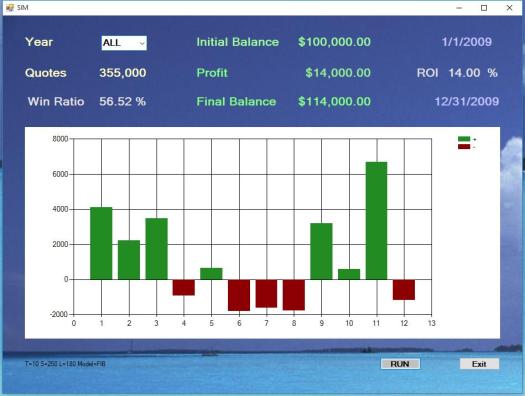

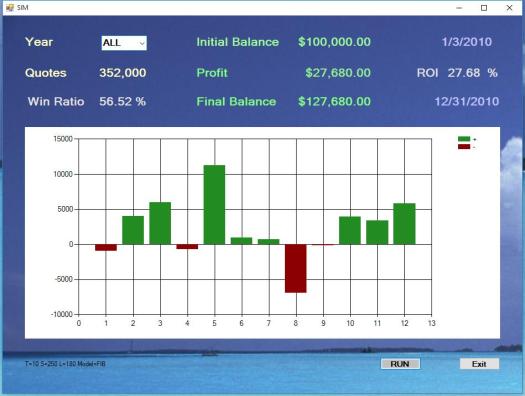

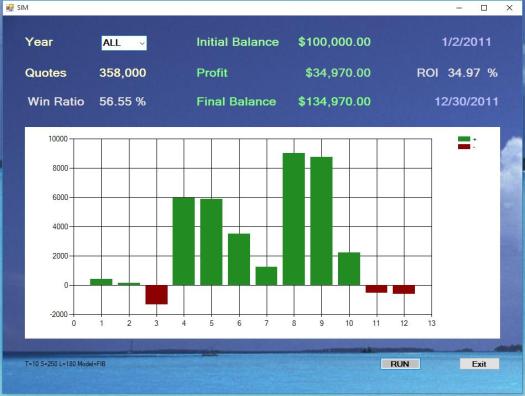

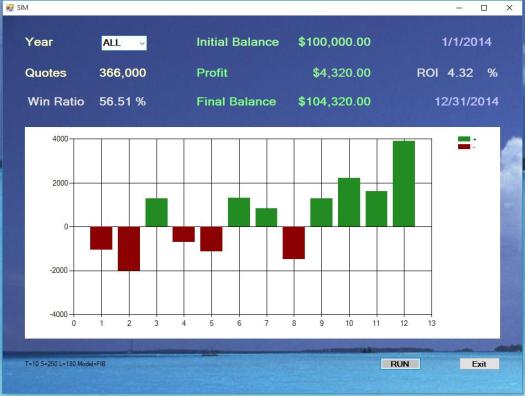

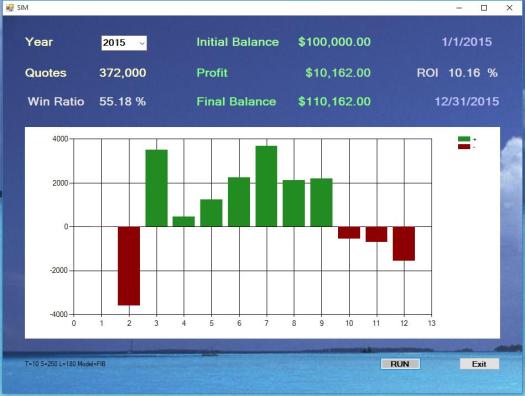

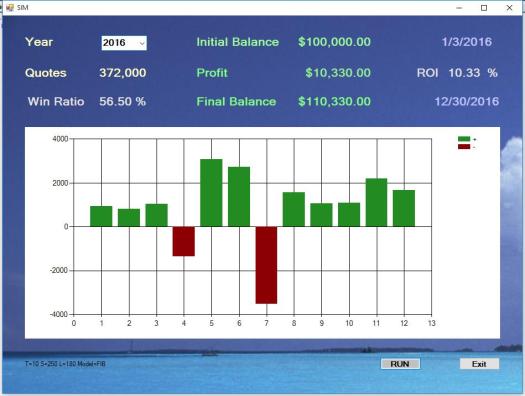

Below are the results from one of the Fibomachi signals (FIB 10-250-180), back tested from May 1st, 2000 to December 2016 trading FOREX EUR/USD. The sample run assumes an initial balance of $100,000 in the trading account on May 1st, 2000, resulting in an ending balance of $376,642 for a yearly average of 16.2% and a cumulative of 276% return on investment. The lowest return was 3.4% in 2013 and the highest was 43.5% in 2008.

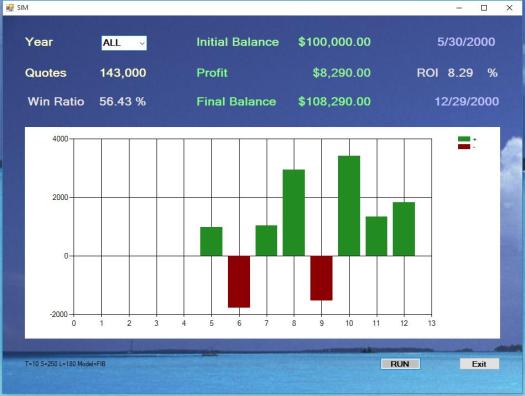

Year 2000

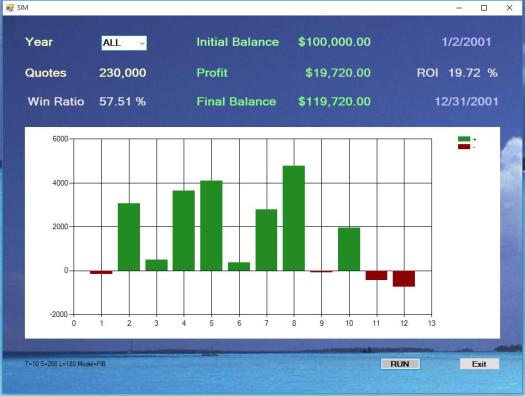

Year 2001

Year 2002

Year 2003

Year 2004

Year 2005

Year 2006

Year 2007

Year 2008

Year 2009

Year 2010

Year 2011

Year 2012

Year 2013

Year 2014

Year 2015

Year 2016

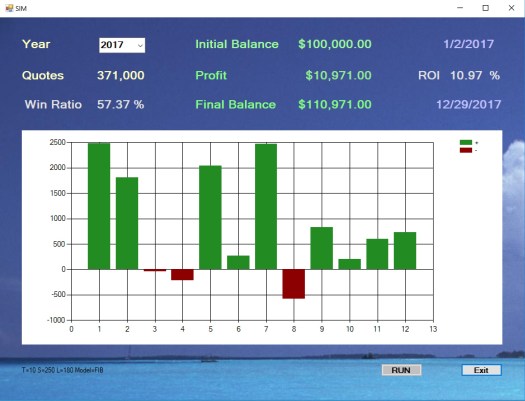

Year 2017